Private Banking_

Private Banking_

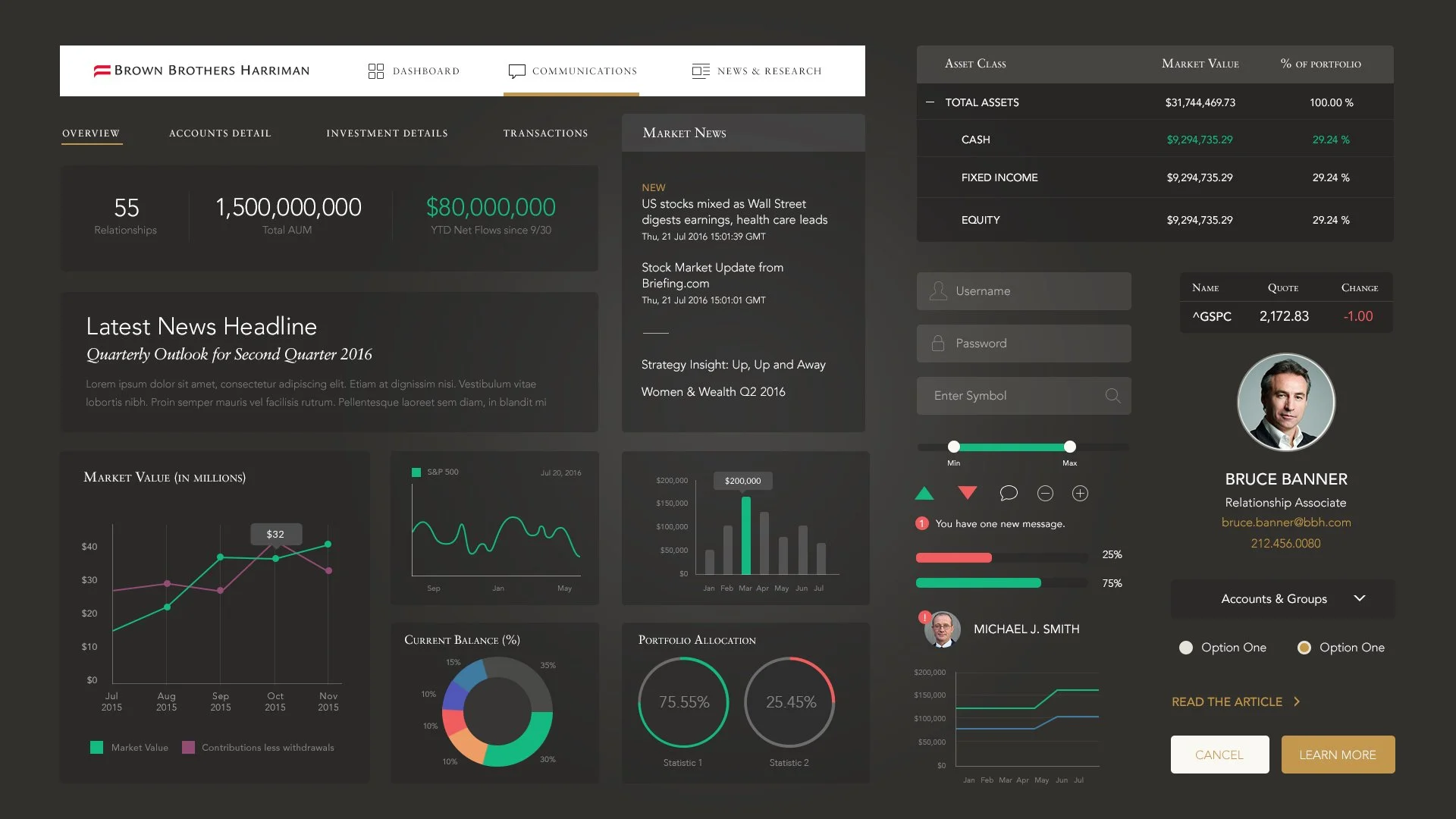

With increased market competition & expanding client needs, BBH was dedicated to elevating their digital capabilities to align with their strong value proposition and high-touch service offerings.

The Challenge

BBH needed to modernize its digital offering to meet the evolving expectations of high-net-worth clients—without compromising the firm’s hallmark white-glove service or exposing complexity in investment data.

The Insight

Clients didn’t just want information—they wanted clarity, confidence, and connection. True value came from tools that enabled real-time collaboration and transparency with their advisors, not from static dashboards.

The Solution

We built a secure, investor-centric platform powered by modular design systems and atomic principles, enabling tailored visualizations, intuitive navigation, and seamless advisor–client interactions—all while preserving BBH’s legacy of trust and discretion.

The portal significantly increased client engagement among BBH’s traditionally offline user base and strengthened long-term advisor relationships. By introducing scalable design systems and decision-support tools, we positioned BBH for sustained digital growth in a relationship-driven market.

By using a investor-centric approach to design; new tools, visualizations and experiences were created to better meet client needs and help build stronger investor relationships.